Summary: Smart Sand is smaller frac sand supplier of primary Northwern White Sand with one primary plant in Oakdale, Wisconsin with acreage in Hixton Wisconsin as well. Produces 40/70 and 100 mesh.

Summary: Smart Sand is smaller frac sand supplier of primary Northwern White Sand with one primary plant in Oakdale, Wisconsin with acreage in Hixton Wisconsin as well. Produces 40/70 and 100 mesh.Competitive Advantage - Small focused play with minimal moving parts. Supposedly they have very little overburden (how much they need to dig to get good sand) and have a cost advantage because of it.

Q2 2019 - Presentation and Conference Call

- Continued growth of the amount of proppant pounds used per lateral foot resulting in the amount of sand need. 106 million tons expected in 2019 and 128 in 2020 while 99 was used in 2018.

- Eastern US demand expected to grow 15% in 2019 from 10.2 (2018) => 12.0 (2019) => 13.5 (2020)

- Bakken Demand expected to grow 16% in 2019 from 9.5 (2018) => 11.2 (2019) => 12.9 (2020)

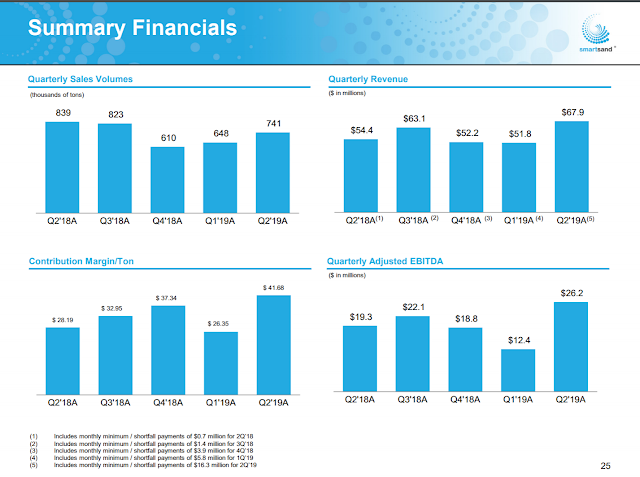

- Sand volume up... Q1 648,000 tons => Q2 741,000 (Q2 2018 of 839,000). Q3 guidance is light at 625k to 725k tons.

- Revs ups... Q1 51.8 million => Q2 67.9 million (Q2 2018 of 54.4 million)

- Contribution margin up... Q1 $26.35 => Q2 $41.68 (Q2 2018 $28.19)

- Adjusted EBITDA $26.233 million. Up from $12.4 million in Q1 and 19.3 million in Q2 2018.

- They have revenue shortfalls of 16.3m (Q2), 5.8 (Q1), 0.7 (Q2 2018) of which 14.5 / 3.8 / and 0 is subject to litigation.

- NI of 14.3 million or .36c a share vs 4 million / $0.10c in Q1 2019 and 10 million / .25 in Q2 2018

- 1.3 million cash and 16 million under revolver available

- Authorized to purchase shares but did not purchase any

- Extended long-term contract with EQT. Volume weighted and almost two years. Analyst asked about at what price and wouldn't give specifics said it was "consistent".

- Reduced total debt from 52.6 million in Q1 to 46.6 million.

- Spot volumes were 19% of sales

- 11.1 million in cash flow from ops

- Analyst asked about July pricing and response was flat to down a little bit in Q3 thus far.

- 50% of volumes going West, 33% to Northeast and 10% to Permian, MidCon, Eagle Ford

- Q3 clarity, analyst asked for more clarity and mgmt said it was conservative with possible room to upside as some customers were talking about busy Q3.

|

| Q2 2019 Financials |

Comments

Post a Comment