The impetus for this blog post is my following of many bagholders over on the $HCR (Hi-Crush) ticker symbol. I have suggested numerous times that a great way to reduce risk, while increasing returns is to take some of your position and convert it to other frac sand plays when HCR is up big. If they so choose they can roll those funds back into HCR when HCR is down big compared to its competitors. Despite this fundamental solution to a common problem investors have - having too big of a position in one equity - nobody has actually done this.

As a result I thought I would explain it in a more apples-to-apples comparison given their similarity in financials, size, and debt. They both have entreprise values of roughly $700 million. For those that are not familiar with FTSI know that they are a pressure pumper and use the frac sand from companies like HCR, SLCA, CVIA, SND, and EMES to complete wells. In this regard if frac sand increases there is a good chance that FTSI business also increases. All those drilled but uncompleted wells (DUCs) will surely help both.

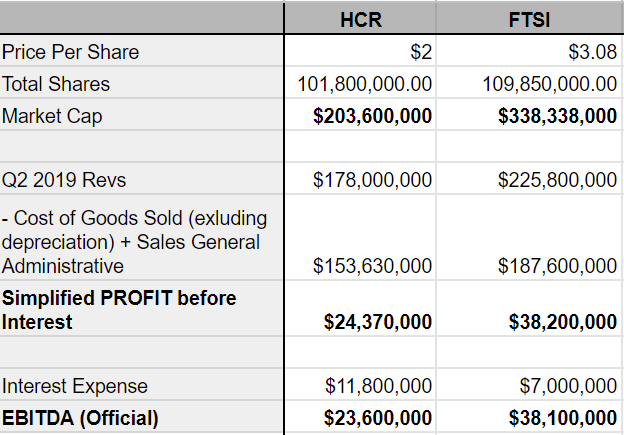

Let's take a look at the simplified income statement:

As a result I thought I would explain it in a more apples-to-apples comparison given their similarity in financials, size, and debt. They both have entreprise values of roughly $700 million. For those that are not familiar with FTSI know that they are a pressure pumper and use the frac sand from companies like HCR, SLCA, CVIA, SND, and EMES to complete wells. In this regard if frac sand increases there is a good chance that FTSI business also increases. All those drilled but uncompleted wells (DUCs) will surely help both.

Let's take a look at the simplified income statement:

|

| Q2 2019 |

As you can see the companies look pretty comparable (relatively) in regards to their stock prices and their revenues and EBITDA. Almost eerily so. FTSI did write down the value of some things this quarter and that affects their official EBITDA in a one-time hit which is already reflected in the above EBITDA as it is the official number . Although this doesn't express the fundamental outlook nor the balance sheet so let's add in the balance sheet:

Looking at the balance sheet. FTSI has $147 million more in current assets and less debt. When you look at the enterprise value of $712 million for HCR and $727 million for FTSI. With a Enterprise Value / EBITDA of 5.07 for FTSI and 6.21 for HCR. HCR continues to spend vastly more on CAPEX as well which shows up in the income statement as depreciation later on as they depreciate it and add it to the cost of goods sold.

What does this all mean? It means that currently HCR is vastly overpriced to FTSI. Partially because FTSI is down big today on two prices cuts from analysts who did not even attend the conference call last quarter. These analysts are not substantial because they don't truly follow the companies in my opinion like a Simmons would and timing wise this was done IMHO to help shorts cover. Ie. this is a huge opportunity for a pair trade today.

There is a good chance that whatever gap in valuation exists today won't be there tomorrow or next week. Even a good chance that FTSI swing to the upside in terms of its relative valuation. What it means to me is that if frac sand declines HCR will fall further and if it increases HCR will not rise as much. Making FTSI a win-win for the HCR investor.

Either way, I am confident that you will be able to buy more shares of HCR in the future should you want to switch back. Maybe not today, maybe not tomorrow, but you will get the opportunity to buy more HCR shares with the proceeds from FTSI in the future. In the meantime you have diversified and reduced your overall portfolio risk while still staying invested.

This doesn't include that FTSI is the far superior company in my opinion. They have a true competitive advantage in doing their own maintenance repairs on their frac equipment which nobody else does. According to conference calls FTSI also has the ability to scale this easily meaning that should a larger pressure pumper be interested in buying a solid company with solid earnings that they have a chance to further expand their own margins thru FTSI's ability to do their own maintenance and thus their own maintenance too.

Nobody is going to be buying out HCR anytime soon. Why would they. There are too many sand mines and many are going out of business. In addition HCR has essentially worthless assets in Wisconsin. FTSI doesn't have that problem or the risk and management has indicated they would be willing to do an acquisition. The price is ripe in my opinion. Last year Silca paid 12x EBITDA for EP Minerals which would a premium of 100% on this and that doesn't even include the fact that we are at or near the bottom in the pressure pumping business so the current numbers look dire.

Both companies are "buying" back shares, however as should be noted by the interest expense line item. HCR debt is far too expensive at 9.5% and vastly higher than FTSI. As a result, as a HCR shareholder I would much rather have them buy back debt and not shares and preserve that cash. I don't think HCR buys back any meaningful number of shares in the future. On the flip side I think FTSI has more room to do so although reducing their debt is just as good as it makes them even more attractive to acquirer.

Comments

Post a Comment